The high and low prices are represented by vertical lines extending from the top and bottom of the bar. If you do not know the doings of Forex, you are bound to make several mistakes and the first step in preventing such from happening is to know how to read the charts. There are numerous kinds of Forex charts but the three we have highlighted here meaning of solvency certificate are the top ones. You could go with whichever you feel suits you and understand how the charts work before diving into the world of Forex. Traders see squeezes as a sign that increased volatility and possible trading opportunities are on the horizon. A chart incorporates all known news, as well as traders’ current expectations of future news.

For most currency pairs, a pip is equal to 0.0001, although some pairs have different pip values. It is very easy to make use of charts as you can get a grasp of the changes in prices by just looking at them. On the chart, you will see how various currencies move and you can ascertain the tendency of going up or down at a particular time.

As a successful forex trader, being able to analyze those inter-day price fluctuations will help you predict future changes and time your buy and sell orders accordingly. While this guide has introduced the basic concepts you need to know to read forex charts, many experienced traders use more advanced technical analysis to forecast price movements. In comparison to the line chart, bar charts are quite complicated though it surpasses line in providing sufficient details.

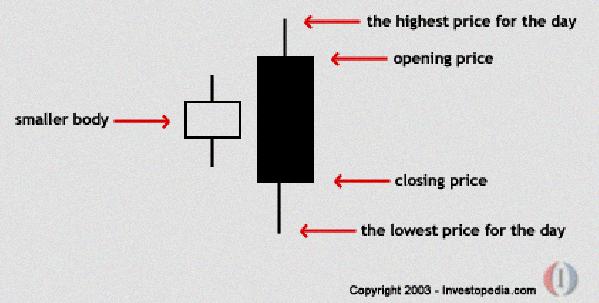

The answer is that it could have been both, or as we discussed above, market movements driven by speculation. The art of successful trading is partly due to an understanding of the current relationships between markets and the reasons that these relationships exist. It is important to get a sense of causation, remembering that these relationships can and do change over time. The first reason is that you want to establish a “big picture” view of a particular market in which you are interested. Since the markets are closed and not in dynamic flux over the weekend, you don’t need to react to situations as they are unfolding, but can survey the landscape, so to speak. For our ‘filled’ blocks, the top of the block is the opening price, and the bottom of the block is the closing price.

Customizing your Forex Charts

These investors believe that companies will have improved earnings and, therefore, greater valuations in the future—and so it is a good time to buy. However, speculation, based on a flood of liquidity, could be fueling momentum and good old greed is pushing prices higher until larger players are on board so that the selling can begin. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools.

The price levels are depicted on a Y or vertical axis, on the right side of the chart. However, more advanced traders may prefer a price chart that offers more information, like the opening price, as well as the day’s high and low… When you trade in the forex market, you’ll need to know a few things, including how to read forex pairs and forex chart patterns. A colored or filled middle block means that the closing price of a currency pair is lower than its opening price.

There are several types of forex charts, including line charts, bar charts, and candlestick charts. The most commonly used type of forex chart is the candlestick chart, which displays the opening price, closing price, high price, and low price of a currency pair over a specific period. Candlestick charts are particularly useful for identifying market trends, as they provide information about the strength and direction of price movements. A forex chart is a graphical representation of the price movements of currency pairs in the foreign exchange market.

How to Read a Currency Quote?

Candlestick charts show you exactly which direction the market is moving in, with red bars representing a lower closing price than the opening price and green bars showing a positive price trajectory. As a forex trader, you can use these helpful indicators to identify specifically whether a currency pair is heading towards a positive or negative trajectory. Furthermore, the price ranges identified by candlestick charts can help you determine whether a currency is due for a breakout moment.

- Get started with Asia Forex Mentor’s proprietary forex trading course (the One Core Program) through the One Core Program or the Golden Eye Group.

- For a short-term trader with only delayed information to economic data, but real-time access to quotes, technical analysis may be the preferred method.

- These are available for free, for a fee, or can be developed by more tech-savvy traders.

- Beginner traders may choose to start with a demo account to practise your analysis without real money.

By zooming out and taking the longer view, you can identify patterns in currency pair prices that can help inform your trading strategy. For example, you might see a 10-year chart for USD/JPY in which it is clear that the value of the Yen to the Dollar falls every time the BOJ cuts interest rates. Being able to identify patterns and correlations such as this is absolutely crucial for profitable forex trading.

Read the chart

The bottom of a vertical bar displays the lowest traded price for that period, while the top shows the highest. Each point on the chart tells you both the opening price of a currency pair and the closing price of that same pair within a certain period, usually within a day. A bar chart can, therefore, give a more detailed picture of the price relationship between a currency pair. This time rate could be as short as the past ten minutes, or as long as the past ten years.

Each box represents a specified value that the exchange rate has to attain to justify marking an X or an O on the graph. There are hundreds of different types of trading indicators developed to cover every aspect of forex trading, from trend following to mean reversion. To help make sense of the currency movements depicted on a chart, traders have developed a number of different visual guides to assist them – indicators. Wicks represent the highest and lowest prices reached during the given time period.

Mountain chart

Traders can look for opportunities to buy near support levels and sell near resistance levels. An uptrend occurs when the currency pair’s price consistently makes higher highs and higher lows. To identify an uptrend, look for a series of higher highs and higher lows on the chart. This indicates that the buyers are in control, and there is a potential opportunity to buy the currency pair.

How to Read Forex Line Charts » FINCHANNEL – The FINANCIAL

How to Read Forex Line Charts » FINCHANNEL.

Posted: Fri, 25 Mar 2022 07:00:00 GMT [source]

The gap you will see between the Ask Line and the Bid Line is the spread, or the commission your broker makes for every trade you place. This post will teach you everything you need to know about reading Forex charts. We have also added some helpful tips so you can customize your own charts, which will enable you to be more productive and help accelerate your learning curve in Forex. With markets skeptical of Bank of Canada’s ability to deliver additional tightening, the Fed’s normalization cycle will be more relevant for USD/CAD in the near term. While the FOMC has indicated it will “proceed carefully”, the situation could change if U.S. price pressures remain elevated. Earlier in the week, BoC kept interest rates steady at 5.0%, but left the door ajar to the possibility of more policy firming in the face of little downward momentum in core inflation.

Fundamental, technical, quantitative… There are a number of methods used by forex traders to predict the movements of currency pairs. Some traders focus on news, interest rates and economic variables while others prefer to use charting tools and indicators to guide their trading decisions. https://1investing.in/ Bollinger Bands are volatility indicators that measure the standard deviation of a currency pair’s price movements over a given period of time. Bollinger Bands consist of a moving average and two bands that are plotted two standard deviations away from the moving average.

What is Forex Price Action Trading? – Benzinga

What is Forex Price Action Trading?.

Posted: Mon, 26 Jun 2023 07:00:00 GMT [source]

A Forex chart is a graphical representation of currency quotes over a period of time. Forex charts are extremely important for Forex traders, as they reveal how currency pairs have performed over time. Line charts connect a set of single exchange rate observations taken per time period with a straight line.

Bar Chart

You will only find out after the period that the price ended at X and nothing more. 86% of retail investor accounts lose money when trading CFDs with this provider. A bar chart is incredibly useful as it allows you to easily see gaps and single out individual time periods, as the bars ensure that nothing overlaps. They can allow you to identify when a currency price has closed above a crucial point, thus signifying a potential breakout. A typical forex chart tells you so much more than just the current and previous price of a currency pair, although this will form the basis of the chart. The chart will always have the time period on the x-axis, and the price differential on the y-axis.

- It has to do with the two axes and the y-axis is on the vertical side, and it stands for the price scale while the time is depicted on the horizontal side which is the x-axis.

- Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website.

- This quick and simple guide will show you exactly how you can make sense of your forex charts to make smarter, more informed trades.

- This line is called the price line and it illustrates the current Bid price of a currency pair.

When you see the word ‘bar’ going forward, be sure to understand what time frame it is referencing. The “future news’ is now “known news”, and with this new information, traders adjust their expectations on future news. Alpari is a member of The Financial Commission, an international organization engaged in the resolution of disputes within the financial services industry in the Forex market. Five Minute Finance has influenced how I see finance – I rely on it for insight on the latest news and trends at the intersection of finance and technology.

The Moving Average Convergence Divergence (MACD) indicator is a trend-following momentum indicator that helps traders identify changes in momentum and trend direction. The MACD is calculated by subtracting a long-term moving average from a short-term moving average. A correction is a temporary reversal in the overall trend of a currency pair. Corrections are a normal part of market movements and can provide opportunities for traders to enter or exit positions at more favorable prices. The body of the candlestick represents the difference between the opening and closing prices, while the wick represents the highs and lows. One of the most important things to keep in mind when reading a line chart is that it only shows the closing price.