For example, in case of advertisement expenses, the benefits of advertisement accrue to an organisation for more than one year. Hence, such expenses are spread over the years in which the benefits accrue to the organisation. The current year expenses are debited to Income and Expenditure Account and the balance is shown under Assets side of the Balance Sheet. Meanwhile, deferred revenue expenditures don’t usually relate to the purchase or acquisition of long-term assets.

HashiCorp Announces Second Quarter of Fiscal Year 2024 … – GlobeNewswire

HashiCorp Announces Second Quarter of Fiscal Year 2024 ….

Posted: Thu, 31 Aug 2023 20:05:00 GMT [source]

According to the Merriam-Webster dictionary, “deferred” means “withheld for or until a stated time”. We’ll be answering these questions (and more) as we move along with the article. This is primarily because there is no corresponding long-term property to represent the expense. Secret reserves are those reserves that exist in the business to strengthen its financial position but are not disclosed in the Balance Sheet. When you access this website or use any of our mobile applications we may automatically collect information such as standard details and identifiers for statistics or marketing purposes. You can consent to processing for these purposes configuring your preferences below.

Deferred revenue expenditure always leads to the creation of an asset on the balance sheet. Now while this revenue expenditure is paid for wholly in the current year, its benefits last for 5 years. Before we proceed with the definition of deferred revenue expenditure, let’s review first what a revenue expenditure is. In this article, we will be looking into what a deferred revenue expenditure is. Because it is technically for goods or services still owed to your customers.

/fa-fire/ Latest Contents$type=list$m=0$cate=0$sn=0$rm=0$c=5$va=0$hide=home

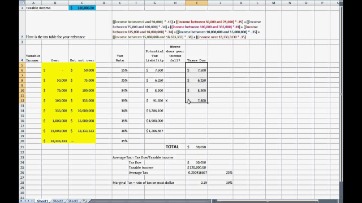

In Debitoor, you can register and track the depreciation of both short and long-term assets over time automatically with straight-line depreciation. This allows you to stay on top of the value of your assets and keep tabs on the financial health of your business. The deferral of expenses can be applied to any purchase that will be consumed in full either in increments or at a later date. The practice of deferring expenditures usually applies to larger, more expensive investments that will be consumed over time. Below is an example of a journal entry for three months of rent, paid in advance.

In this case, the business creates a deferred revenue expenditure account to match up the expense with the value received, similar to depreciation accounts but for a different set of activities. The question of whether expenditure is capital or revenue for tax purposes is one of tax law. It follows that expenditure that is revenue for tax purposes does not, and cannot, lose that character whether it is charged wholly in one year’s accounts or spread over the accounts of more than one year.

Accounting Treatment of Deferred Revenue Expenditure

In some cases, it may be necessary to adjust the carrying value of a deferred revenue expenditure if there is a change in the estimate of the future benefits to be received. For example, if a research and development project is expected to take longer to complete than originally thought, the carrying value of the deferred revenue expenditure would need to be increased. Conversely, if the project is completed sooner than expected, the carrying value would need to be decreased.

Deferred revenue expenditure refers to the expenditure incurred by an organization that will provide benefits in future periods. Deferred revenue expenditures are revenue in nature; however, benefits that can be derived from them will last for many years. A portion of expenditure will be written off yearly in proportion to the benefit derived from the same. Generally, whenever It is incurred, it will disclose on the asset side, and every year portion of it will be written off in the income statement. Such expenditure is revenue; however, its benefit will likely be available in over a year.

Difference Between Income and Cash Flows

The concept of deferred revenue expenditure is essential for accurate financial reporting and the matching of expenses with the periods in which the related benefits are realized. This act of deferring revenue expenditures gives rise to a new type of expense that we refer to as deferred revenue expenditures. If you are in any doubt about whether such treatment is in accordance with GAAP in a particular case, you should obtain advice from an HMRC Advisory Accountant. It’s important to account for your business’s deferred revenue expenditure as it represents future expenses that you’ve already paid for.

- In other words, expenditure does not become capital expenditure for tax purposes by being ‘capitalised’ in the accounts; ‘capitalised’ revenue expenditure is still revenue.

- Capital expenses always lead to the creation of long-term asset accounts such as building, land, equipment, machinery, copyright, etc.

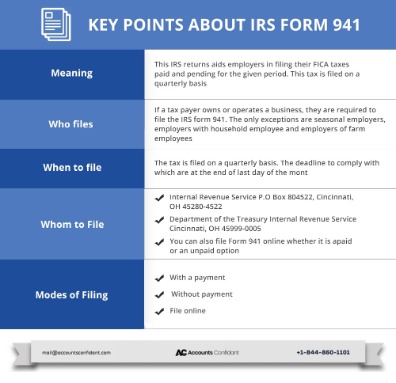

- Since deferred revenues are not considered revenue until they are earned, they are not reported on the income statement.

- If you are planning to avail a Home Loan, then it is crucial for you to understand under what conditions your bank is sanctioning the loan.

Deferred Revenue Expenditure implies the expenditure incurred in the course of business during the current accounting period but the benefits arising out of it can be enjoyed over the years in the future. Accountants often refer to ‘capitalising’ expenditure without implying anything about its treatment as revenue or capital expenditure for tax. They simply mean that expenditure is taken to the balance sheet because it relates to a later year. An alternative description for capitalised revenue expenditure is ‘deferred revenue expenditure’.

Deferred expenditure & Debitoor

The main drawback of deferring revenue expenditures is that it can result in a higher tax bill in the short term. This is because, in most jurisdictions, taxes are paid on profits in the year in which they are earned. Thus, if a company defers a revenue expenditure, it will have lower profits in the year in which the expenditure is incurred and this could result in a higher tax bill.

SentinelOne Announces Second Quarter Fiscal Year 2024 Financial … – Manchestertimes

SentinelOne Announces Second Quarter Fiscal Year 2024 Financial ….

Posted: Thu, 31 Aug 2023 20:10:31 GMT [source]

Financial Dictionary has been created to help anyone, interested in understanding financial terms. It is extremely important to know what the financial terms mean when signing on terms and conditions. When availing financial products, you can be easily cheated if you don’t know what you have signed up for. Capital expenses always lead to the creation of long-term asset accounts such as building, land, equipment, machinery, copyright, etc.

This expenditure is not written off from the profits of the year in which it was incurred; instead, it is spread over the number of years for which the benefit is expected to last. If you are a Financial Advisor, then it is extremely important to stay updated on the latest financial terms. We at IndianMoney.com update all the new terms used in personal finance in the Financial Dictionary. This is a double bonanza of increasing your efficiency and fetching clients more money. While they have the potential to increase the business’s total revenue, they don’t increase earning capacity. In this example, the business can benefit from a potential increase (or at the very least, retention) in its revenue due to the advertising contract.

As the expenses are incurred the asset is decreased and the expense is recorded on the income statement. On the other hand, while a deferred revenue expenditure usually covers several periods, it sometimes only covers a period of one year or less. Under the cash basis of accounting, deferred revenue and expenses are not recorded because income and expenses are recorded as the cash comes in or goes out. This makes the accounting easier, but isn’t so great for matching income and expenses. Learn more about choosing the accrual vs. cash basis method for income and expenses.

Such a class of revenue expenditure is regarded as deferred revenue expenditure. Therefore, instead of charging the total amount of expenditure from the Profit and Loss Account, the expenditure is written off over certain years. Revenue and capital expenditures are expenses ingrained in the daily operation of a business. In this lesson, compare and contrast expanded accounting equation these types of expenditures, including examples of each and how they are considered on a balance sheet. The accountancy treatment is not relevant for expenditure which is ‘capital’ in tax terms. But it is a separate issue whether revenue expenditure which is ‘capitalised’ by accountants is also disallowable in computing taxable trade profits.

Deferred expenditure in practice

Rather, capital expenses are treated as assets that the business will depreciate (for tangible properties) or amortize (for intangible assets) over their respective useful lives. A deferred expenditure is placed on the balance sheet as an asset, since it is something that has been paid a certain amount for, but has not yet been used in its entirety. Some are considered current assets, if they are used fully within a year. In a number of circumstances GAAP either permits or requires expenditure to be ‘spread’ or ‘deferred’ in accounts; in other words, the expenditure is charged to the profit and loss account of more than one year.